The best high-yield savings accounts (HYSAs)

Opening a HYSA is low hanging fruit!

Some banks offer their customers really great interest rates with no minimums or strings attached. They do so for a variety of reasons:

1. Their heavier online presence means they have a small brick & mortar footprint and in turn, pass on their "lower costs"

2. Regulations require banks to hold a certain amount in deposits, and this is a way to attract cash

3. As the Fed increases rates, banks still make far more money lending it out

I'm biased in favor of banks with larger asset sizes and that are known to have great customer service, but in general, any bank account that is FDIC insured should be fine. With smaller banks, you may risk an SVB-like situation (despite the FDIC's laser-fast response).

| Bank name | Current APY | Domestic assets |

| Marcus (Goldman Sachs) | 4.40% | $464b |

| Capital One 360 | 4.25% | $468b |

| American Express Bank | 4.30% | $175b |

| Ally Bank | 4.25% | $186b |

| Discover Bank | 4.25% | $150b |

Note: Interest rates as of Apr 16, 2024

My only other recommendation is that if you can open up a HYSA with a bank you already have a pre-existing relationship with (e.g., a credit card, loan), that can help consolidate and cut down on the number of log-ins you need to generate.

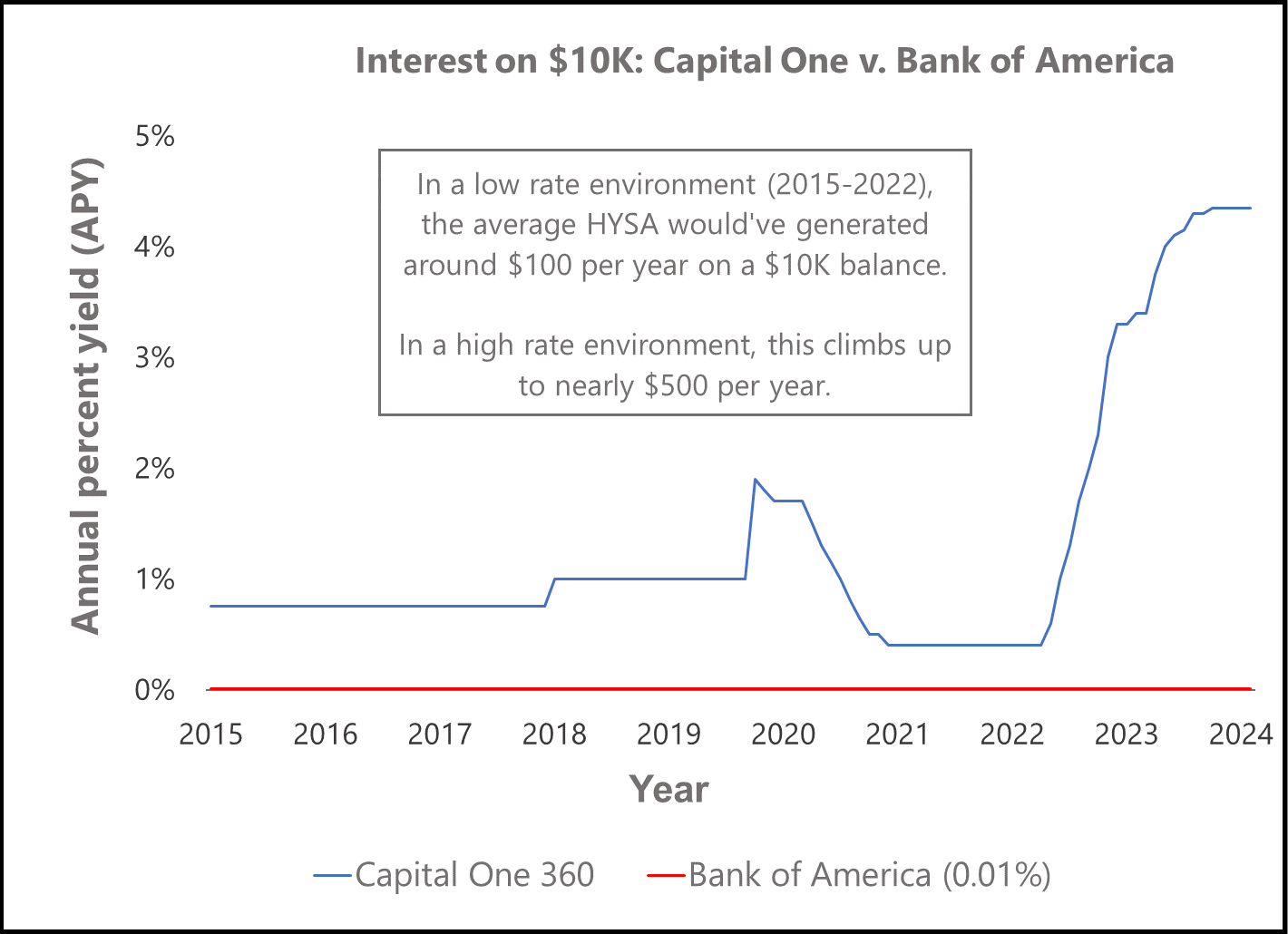

In summary, this is free cash - and no matter how much you have in your savings account, you shouldn't turn down free cash. The chart below should help demonstrate this: regardless of the interest-rate environment, HYSAs always have higher returns than traditional savings accounts.