Treasury money market funds (MMFs)

Treasury money market funds (which are essentially mutual funds that only hold short-term U.S. Treasuries) can be an excellent alternative to high-yield savings accounts. Not only do they provide higher risk-free return than most high-yield savings accounts (HYSAs), the interest that you generate is exempt from state and local income tax. This is particularly advantageous in states with a high income tax such as New York and California but less relevant in states with no or low income tax.

Purchasing Treasury MMFs

You can only purchase Treasury MMFs in a brokerage account - you can see here my recommendations for the best U.S. brokerage firms. Because each brokerage has created their own Treasury MMF (despite being composed of the same underlying assets: short-duration U.S. Treasuries), what you'll purchase will differ by who your broker is, which you can find in the table below.

| Brokerage name | Treasury MMF | APY* |

| Schwab | Schwab U.S. Treasury Money Fund (SNSXX) | 5.02% |

| Fidelity | Fidelity Treasury Only MMF (FDLXX) | 4.98% |

| Vanguard† | Vanguard Treasury MMF (VUSXX) | 5.29% |

* Treasury MMFs report APY an annualized 7-day yield. This is because the Treasuries a fund holds are constantly expiring and new ones are bought. The 7-day yield will fluctuate but will be higher than HYSA in a high-interest rate environment.

† Yields are reported after expenses. VUSXX has a notably lower expense ratio than SNSXX and FDLXX, but Schwab and Fidelity will charge fees to purchase VUSXX to steer you to their funds.

Liquidity

Because you're purchasing these as a mutual fund in a brokerage account, you should also note that it will take one extra day to transact. However, unlike CDs and purchasing Treasuries directly, your cash is fully liquid.

SIPC insurance

Since Treasury MMFs are purchased in a brokerage account, in the event of a brokerage failure, you are protected by insurance from the Securities Investor Protector Corporation (SIPC) and not FDIC insurance. The SIPC will treat Treasury MMFs as a security and provide insurance up to $500K.

The underlying asset is a U.S. Treasury, which are debt instruments issued by the U.S. Department of the Treasury. This is considered a risk-free investment because it is backed by the full faith and credit of the U.S. government. In the event that the U.S. government defaults on Treasuries, FDIC insurance will not be worth the paper it's written on.

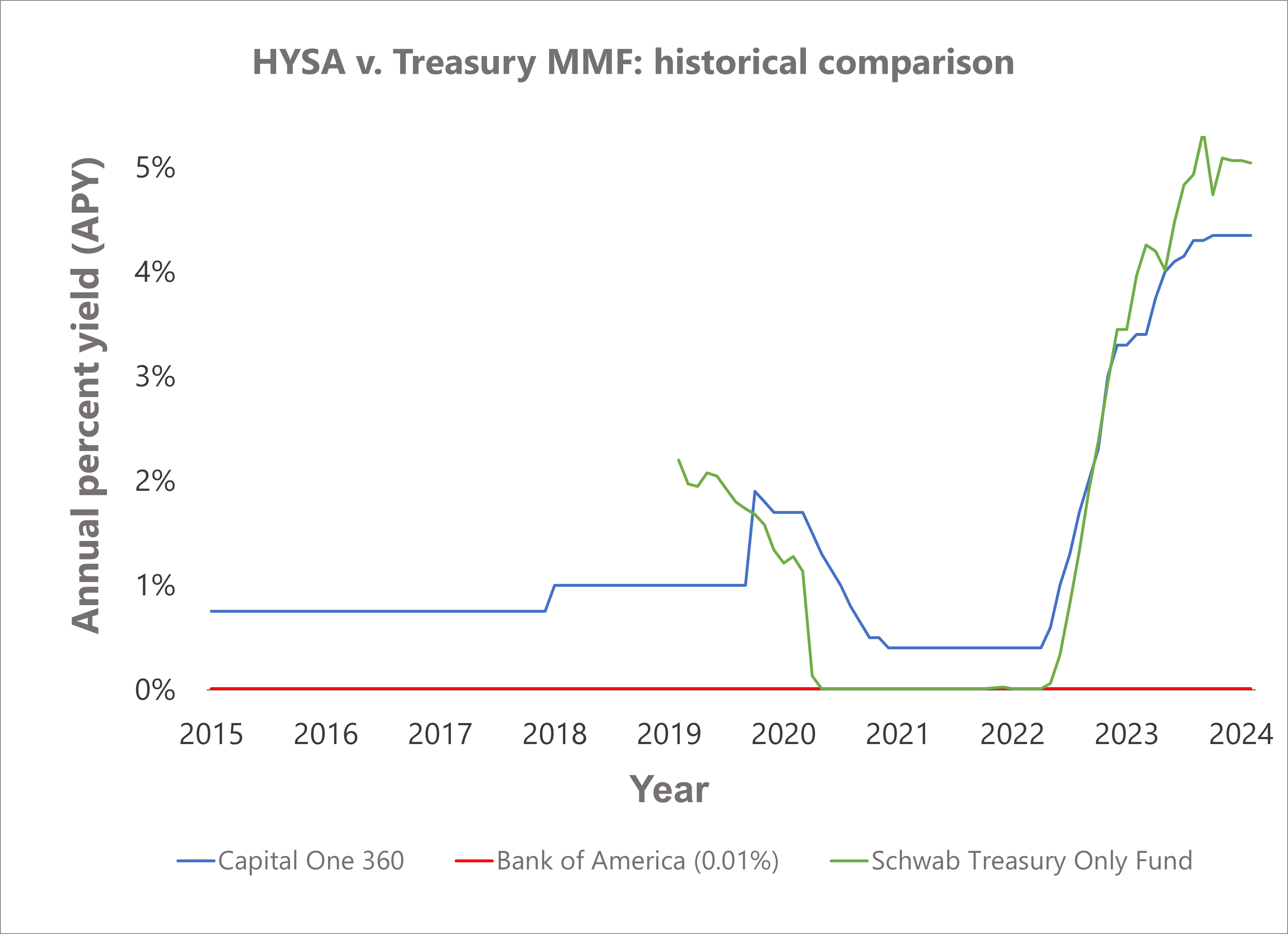

Historic yields against HYSA

Historically, Treasury MMF have outperformed HYSA interest rates set by the Fed are above zero. Intuitively, this makes sense: when rates are zero, banks still have depository requirements, and HYSAs are one way to attract cash. In times when rates are above zero, banks can still profit from the spread between U.S. Treasuries and what they offer in a HYSA.

Note: SNSXX was incepted in 2019.