How to tax loss harvest

Tax loss harvesting is a strategy that you can use to reduce your tax liability. Robo-advisors use it as one of their biggest selling points, and I don't think it's worth it:* in general, your ability to tax loss harvest is limited (the market usually trades at all-time highs), tax loss harvesting delays taxes instead of eliminating them, and the robo-advisor management fee will quickly wash away any present-year tax savings you see.

Also, it's easy to DIY.

* Unless you're in a very high marginal tax bracket that's meaningfully higher than your long-term capital gains tax, though it's still not worth paying for.

Skip to:

What is tax loss harvesting? | How do I DIY tax loss harvesting?

What is tax loss harvesting?

Tax loss harvesting involves selling an investment that you've purchased at a loss and using the proceeds from the sale to purchase a "similar" investment. The IRS then allows you to deduct the loss from your income in the present tax year (up to a maximum of $3K). However, because the new purchase is resetting your cost basis, tax loss harvesting is a strategy that delays taxes, not one that eliminates taxes.

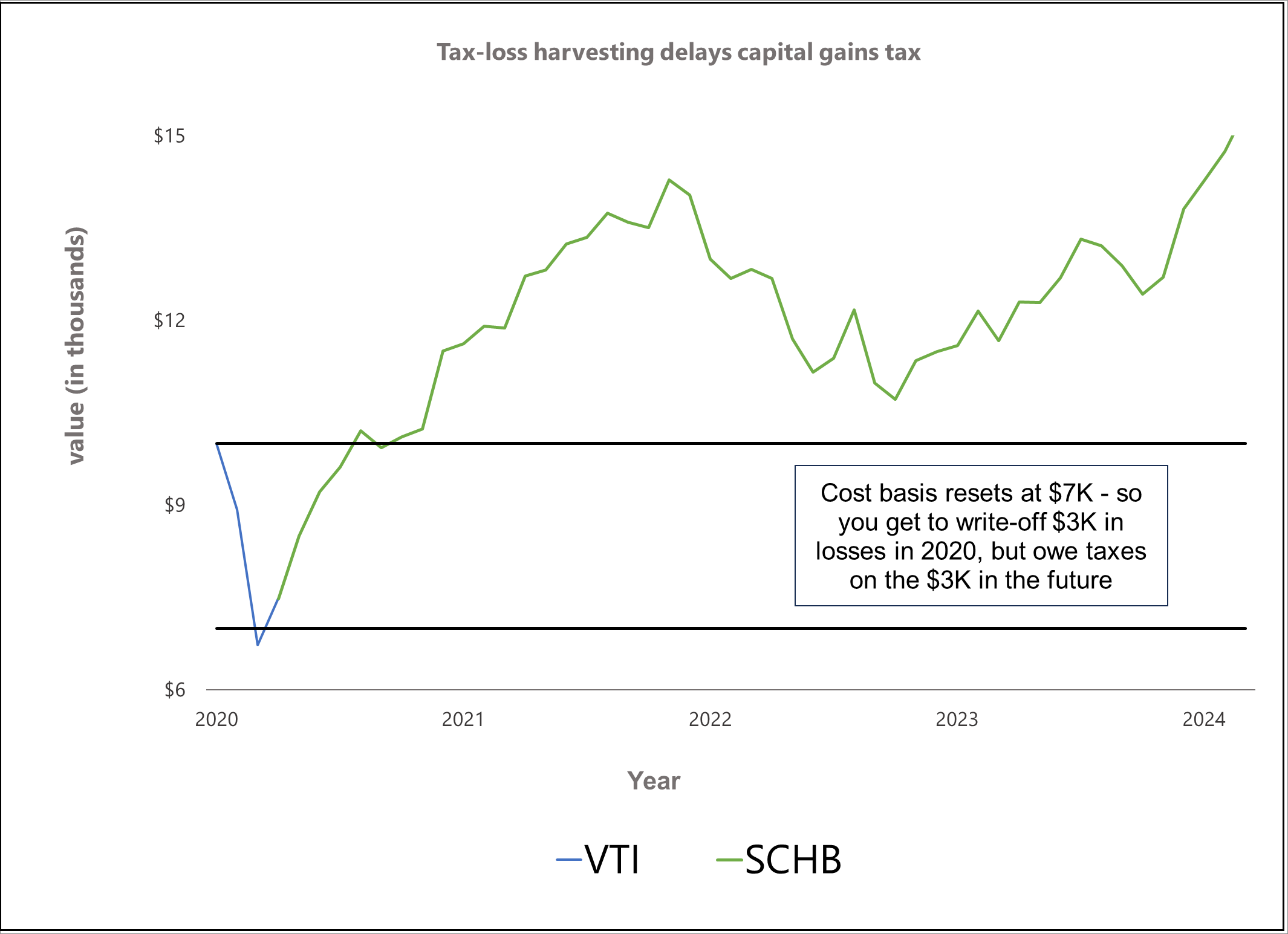

For example, suppose you invested $10K into VTI (a Vanguard index fund that tracks that the CRSP US Total Market Index) in January 2020. In March 2020, US markets plummet by around 30%. VTI is now worth $7K, so you sell it at a loss of $3K and repurchase SCHB (a Scwhab index fund that tracks the Dow Jones U.S. Broad Stock Market Index) at a new cost basis of $7K. You get to write-off $3,000 from your taxes for 2020, which allows you to save anywhere between $300 and $660 from Federal taxes (for most Americans) for that year.

Now it's March 2024: the $7K investment is worth $14.4K and you want to sell it. You incur the long-term capital gains tax, but the cost basis is no longer measured from $10K. In other words, you are now paying the long-term capital gains tax on the $3K losses you harvested in 2020 (i.e., $10K - $7K). This will vary based on income, but in most cases before retirement, will be 15%, and in this case, $450. Depending on your marginal tax rate in 2020, this may end up costing you more money down the road.

How do I DIY tax loss harvesting?

The White Coat Investor has great step-by-step instructions on how to tax loss harvest.