The best brokerages

Charles Schwab revolutionized investing in 2019 by eliminating transaction fees for trades. Since then, most brokerages have followed suit! For those just getting started with their investing journeys or looking to move away from a financial advisor or robo-advisor (e.g., Wealthfront, Betterment), I'd recommend opening an account with Schwab, Fidelity, or Vanguard - I cover the pros and cons of each below.

Skip to:

What you should expect in 2024 | Comparing Schwab, Fidelity, and Vanguard | Transferring brokerages

Expectations of a brokerage in 2024

If you want to stick with your current brokerage, make sure it fulfills the four conditions below:

1. No transaction fees

Practically all brokerages have eliminated transaction fees thanks to Schwab but thought I'd mention this just in case!

2. No management fees

Financial advisors (FAs) usually charge a management fee of 1% per year, and the least expensive robo-advisors (i.e., Wealthfront and Betterment) hover around 0.25%. Use this calculator to see how much these fees cost you over time, and whether you should be paying them.

3. Excellent customer service

Things go awry sometimes: make sure your brokerage has good customer service. Schwab and Fidelity offer 24/7 support as well as branches you can walk into.

4. Ability to automate transactions

See here on how to set up auto-investing for Schwab, Fidelity, and Vanguard.

If your current brokerage falls short and you want to move over to a new one, it's pretty simple to initiate an ACATS transfer. ACATS transfers will move over your current assets and cost basis information so there won't be any tax consequences. I provide instructions here.

Brokerage comparison: Schwab, Fidelity, and Vanguard

This is a brief comparison that highlights the difference between my three favorite brokerages.

| Criteria | Schwab | Fidelity | Vanguard |

| Transaction / holding fees | $0 / 0% | $0 / 0% | $0 / 0% |

| Banking-related benefits | Fee-free ATM withdrawals, domestic and abroad through Schwab checking account; high-yield MMF in brokerage | Auto-bank sweep into high-yield MMF funds | Auto-bank sweep into high-yield MMF funds |

| Auto-investing | Yes, into Schwab mutual funds | Yes, into ETFs and Fidelity mutual funds | Yes, into Vanguard mutual funds |

| Customer service | Top-notch | Top-notch | Lackluster |

| User interface (UI) | Top-notch | Top-notch | Lackluster |

Note: Don't worry if you don't understand some of these terms! You really can't go wrong between the three, though I'm biased in favor of Schwab and Fidelity for their well-regarded customer service.

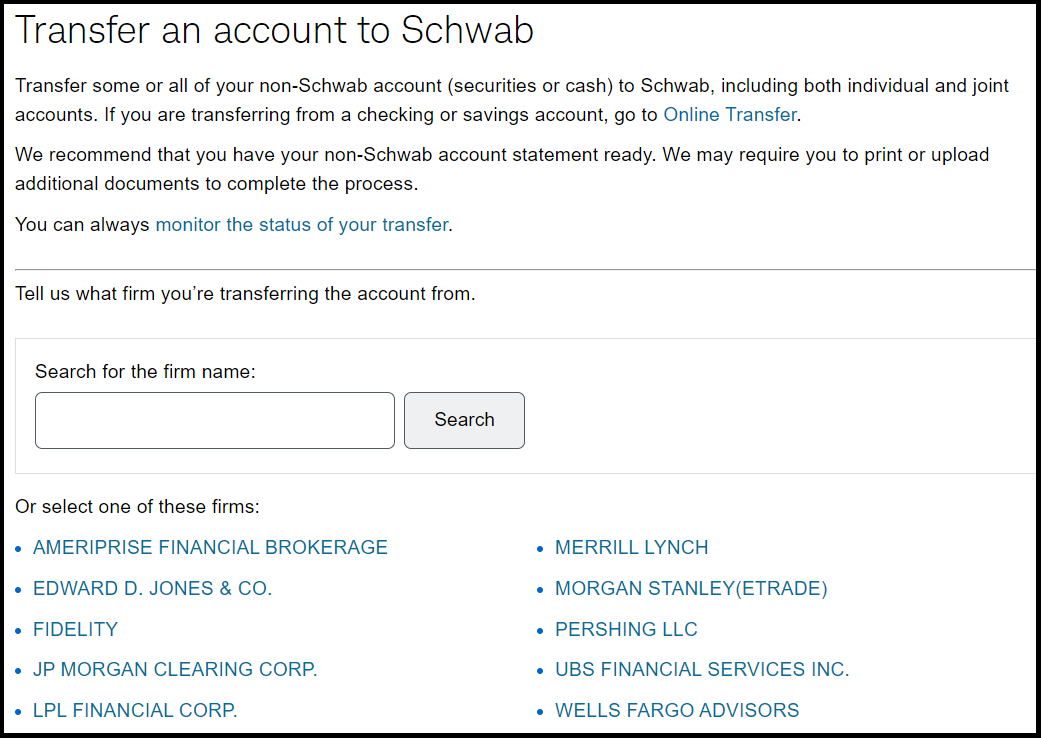

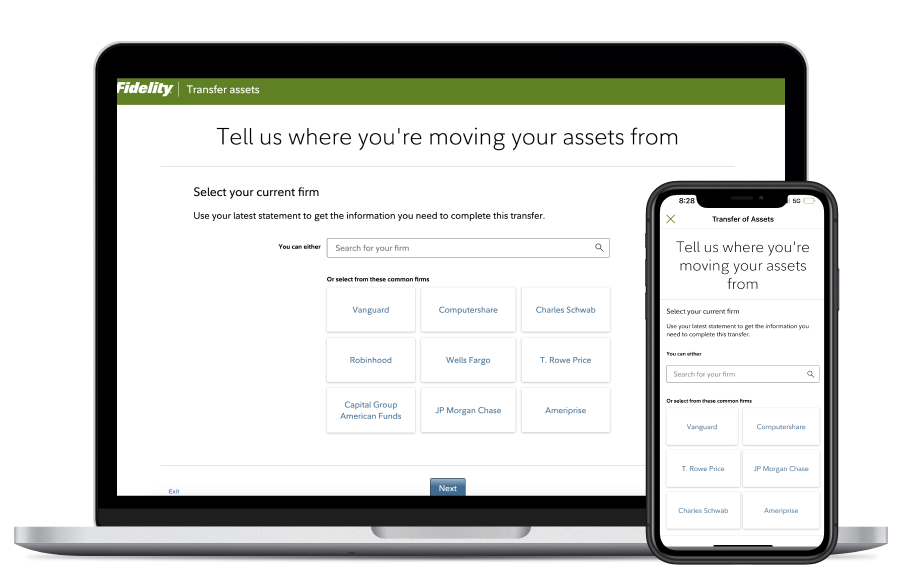

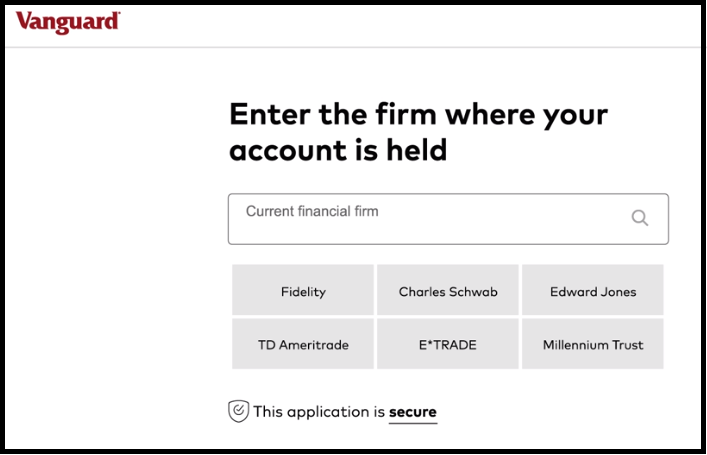

Transferring brokerages: ACATS transfers

Transferring brokerages is really easy -- a lot easier than most people think! Once you open up a brokerage account, Schwab, Fidelity, and Vanguard can all initiate an ACATS transfer: this will transfer the securities you hold "in-kind" or "as they are" without any tax consequences with cost basis information (what price the securities were bought at). As a former Wealthfront user, I've found the ACATS transfer process with Schwab to be extremely smooth but note that cost basis information will be sent separately from the securities, so don't be alarmed if it doesn't show up right away. The whole process takes about 2 weeks.

Almost all account types can be transferred over (e.g., Traditional IRAs, Roth IRAs, taxable brokerage accounts), and all three brokerages will guide you step-by-step based on which firm you're transferring over from.