Investing order of operations

When you start investing, you'll want to make sure that you first prioritize tax-advantaged accounts that you have access to before moving onto a taxable brokerage account.

Skip to:

Why? | In what order? | 401(k) | Health Saving Account | Roth IRA | Backdoor Roth IRA | Taxable brokerage

Why?

Tax-advantaged accounts allow you to either take an up-front tax deduction (e.g., pre-tax based accounts like 401(k)s) or shield the growth from taxes in the future (e.g., after-tax based accounts like Roth IRAs). Meanwhile, a taxable brokerage account is taxed on both sides: you contribute post-tax dollars, and the growth is subject to capital gains taxes.

For example: if you contributed $7,000 a year to a Roth IRA for the next 20 years, you could expect it to grow to $2.8m and not pay any taxes when you start withdrawing. If you contributed this to a taxable brokerage account, you would expect to pay capital gains taxs on about $2.66m (i.e., account balance after growth less $140,000 of contributions).

In what order?

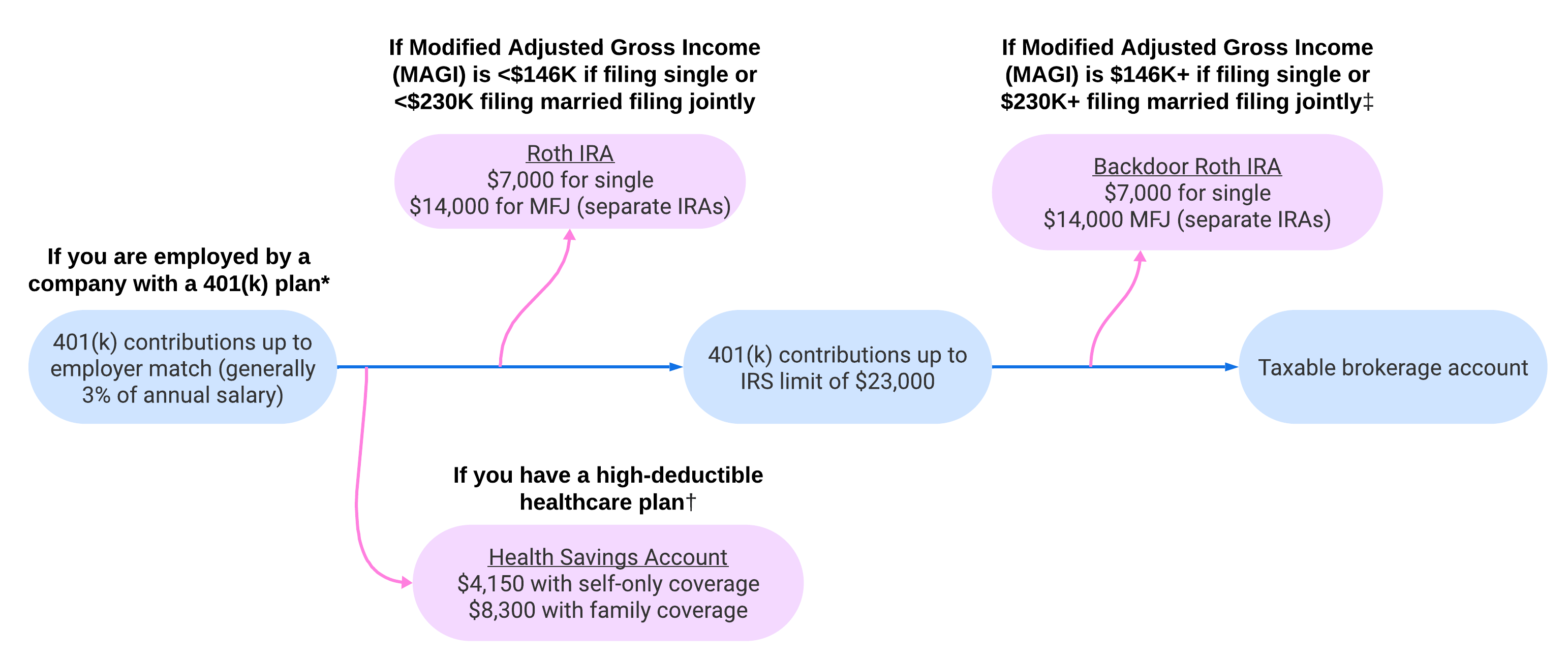

Here's a diagram on the "order of operations" to follow when investing:

* Or any employer-sponsored account with a matching benefit.

† The IRS has a strict definition on what constitutes a high-deductible health plan (HDHP).

* You will want to ensure you have no pre-tax funds in a Traditional or Rollover IRA to avoid the IRS's pro-rata rule. Read more details on how to initiate a Backdoor Roth here.

You can find more details on each of these tax-advantaged accounts below!

401(k)

A 401(k) is a retirement savings plan (sponsored by employers) that allow employees to contribute a portion of their salary toward retirement. Your contributions can be either pre-tax (Traditional) or after-tax (Roth). I provide more details on 401(k)s here in the retirement section as well as on how to decide between pre-tax and Roth contributions.

Health Savings Account

A Health Savings Account (HSA) is a tax-advantaged savings account available to individuals enrolled in a high-deductible health plan (HDHP). It is designed to help account holders save for medical expenses that their health insurance plan does not cover. One of the key benefits of an HSA is its triple tax advantage.

First, contributions made to an HSA are typically tax-deductible, meaning the amount contributed is subtracted from your income, reducing your overall tax liability for the year. Second, any interest or investment earnings generated by the funds within the HSA are tax-free, allowing the account to grow over time without being subject to income tax. Finally, withdrawals from the HSA are also tax-free, as long as they are used for qualified medical expenses, which can include a wide range of health-related costs such as doctor visits, prescription medications, and certain medical procedures.

After you turn 65, you can withdraw from an HSA without penalty. In essence, this makes it an extremely versatile account that can be used both for medical expenses and retirement expenses.

Roth IRA

A Roth IRA is a retirement account that you can open independently, offering tax advantages similar to a Roth 401(k). For 2024, the contribution limit is $6,000 ($7,000 if you're 50 or older). You can contribute to a Roth IRA directly if your Modified Adjusted Gross Income (MAGI) is less than $146,000 for those filing 'single' and less than $230,000 for those filing 'married, filing jointly.' If needed, the contributions - but not the gains - can be withdrawn after 5 years. I provide more details on Roth IRAs in the retirement section.

Backdoor Roth IRA

Technically, the "Backdoor Roth" isn't an account but a process: you're still contributing to a Roth IRA. In essence, you're contributing post-tax dollars to a Traditional IRA (an account I do not recommend unless used for the Backdoor Roth process or a rollover) and immediately "converting" it to a Roth IRA. Because you're converting post-tax dollars, you won't be subject to any additional taxes in the conversion year, and since the money's final destination is a Roth IRA, it can grow tax-free. If needed, the contributions - but not the gains - can be withdrawn at any time. I provide more details on the Backdoor Roth process in the retirement section.

Taxable brokerage

Taxable brokerage accounts should be one of the last accounts you prioritize. Contributions you make to a taxable account have already been taxed once - and then, any growth you see in the account will be taxed once more as capital gains.Some would argue that a taxable account provides easier access to funds, but remember, (i) money doesn't belong in equities if you intend to withdraw it in fewer than 10 years, (ii) you can always withdraw the contributions you make to a Roth IRA, and (iii) the IRS has a number of exceptions that allow you to withdraw from retirement accounts if you ever need the funds.