What to invest in: retirement accounts

The simple answer is a passive target date fund (TDF)! I love passive TDFs because they give you the benefits of diversification for cheap and remove investor psychology (i.e., emotionally-driven decision-making in investing).

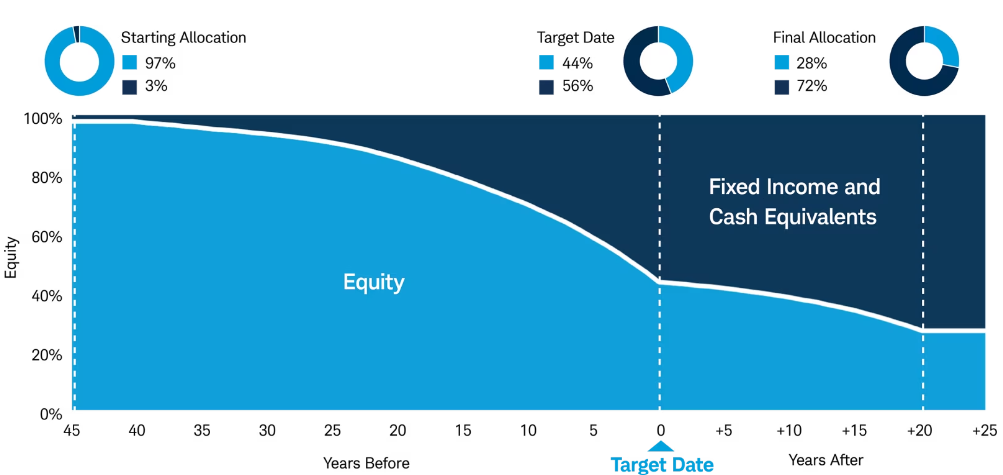

At a very high-level, TDFs are highly-diversified mutual funds with exposure to U.S. equities, international equities, and bonds. When you're younger and many years away from the "target date" (i.e., retirement), the TDF will hold more equities (since you can take on more risk). As you get closer to retirement, the fund will shift toward bonds to stabilize the portfolio. This is what's known as a glide path, and below you can find an example of the glide path for Schwab funds.

TDFs in 401(k)s

For 401(k)s, fund choices can be limited based on your employer. If you're picking a TDF in a 401(k), here are the specific attributes you want look for:

1. Expense ratio under 0.15% (you're paying $1.50 for every $1,000 managed)

2. Has exposure to both domestic and international equities

3. No transaction fees from the broker!

BlackRock LifePath TDFs are commonly offered in 401(k)s and overall are very solid, meeting all three of the criteria I list above.

TDFs in IRAs

IRAs offer more flexibility in fund choices, but you will always be steered toward the TDFs created by the asset management division of your brokerage. However, my favorite TDFs are part and parcel with my favorite brokerage firms and are listed below.

| Brokerage | Target Date Fund name | Net expense ratio |

| Schwab | Schwab Target Index Funds | 0.08% |

| Fidelity | Fidelity Freedom Index Funds | 0.12% |

| Vanguard | Vanguard Target Retirement Funds | 0.08% |

Note: If you're buying the Fidelity fund, ensure it is the "Fidelity Freedom Index Funds"; the "Fidelity Freedom Funds" are actively managed.

Some final thoughts:

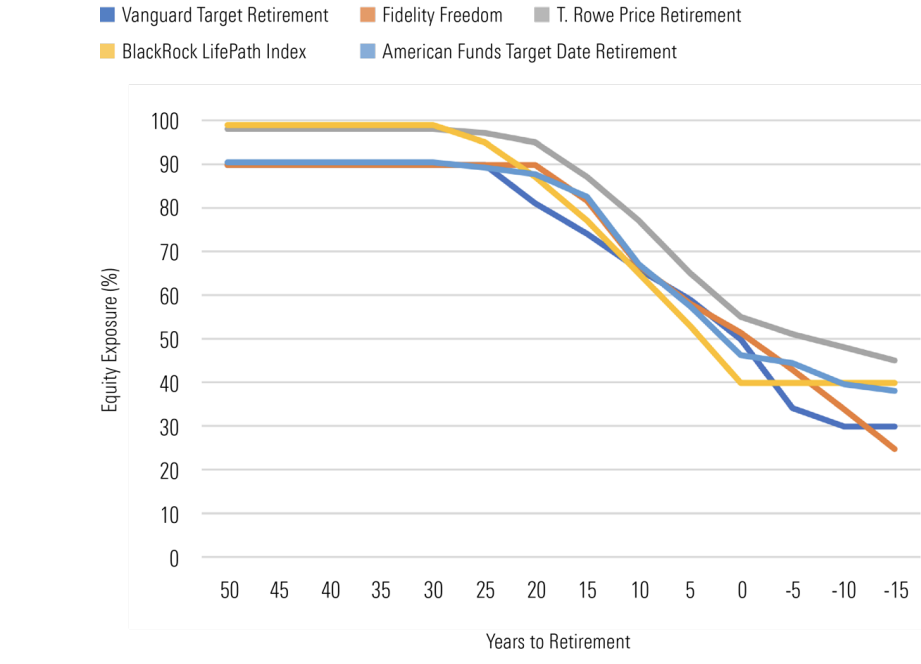

1. As you can see below, the glide paths across different passive TDFs tend to be similar, so you don't need to worry about not having access to a specific one. You can see more details here in this whitepaper from Morningstar.

2. If you want to take a more conservative approach, you can pick a TDF with a "target date" that's earlier than your anticipated retirement date; and if you want to take a more aggressive approach, you can pick a TDF with a "target date" that's further out - this would delay the shift to bonds but would still remove investor psychology.