How to allocate between a Traditional and Roth 401(k)?

If you're reading this page, I assume that your employer offers both a Traditional 401(k) and Roth 401(k). If that's the case, before you read on, I recommend that you quickly read this page on which order to contribute to accounts to minimize future taxes - it'll give you a better handle on what'll be mentioned here.

The biggest drivers in deciding whether to contribute to a Traditional 401(k) or Roth 401(k) will be your income / current marginal tax rate and anticipated future marginal tax rate.

Coming soon: a calculator that will take into account your income, current 401(k) and IRA balances, required minimum distributions, and Social Security benefits to guide you toward the right decision!

Income and marginal tax bracket

Your income determines your marginal tax bracket. If you're in a low marginal tax bracket, you'll want to steer more toward the Roth 401(k) (post-tax), and if you're in a high marginal tax bracket, you'll want to steer toward the Traditional 401(k) to take the up-front tax deduction.

Caveat: In retirement (assuming that you don't have major passive income sources), your income will always start in the lowest tax bracket, and you will want to ensure you have some funds in a pre-tax account so that you can start withdrawing at the lowest tax bracket first.

| Federal marginal tax rate | Single | Married, filing jointly | DIYFi recommendation |

| 10% | $0 - $11,000 | $0 - $22,000 | Roth |

| 12% | $11,001 - $44,725 | $22,001 - $89,450 | Roth |

| 22% | $44,726 - $95,375 | $89,451 - $190,750 | Blend, tilted Roth |

| 24% | $95,376 - $182,100 | $190,751 - $364,200 | Blend, tilted Trad. |

| 32% | $182,101 - $231,250 | $364,201 - $462,500 | Traditional |

| 35% | $231,251 - $578,125 | $462,501 - $693,750 | Traditional |

| 37% | $578,126+ | $693,751+ | Traditional |

Anticipated future marginal tax rate

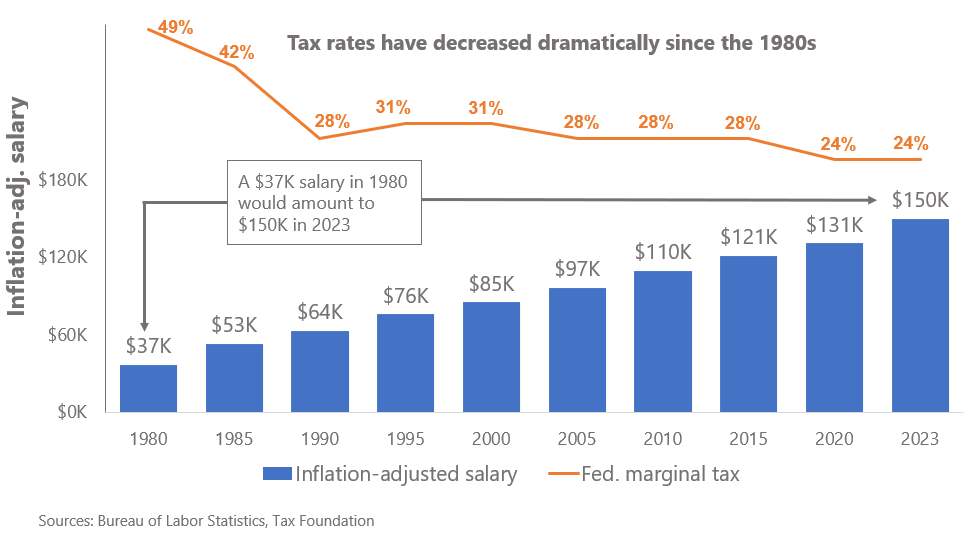

This is a tricky exercise: your future marginal tax rate is hard to predict, both because the government can revise the tax code and it's hard to estimate how much you'll spend in retirement per year. But as the figure below shows, we currently live in an era of low taxes - and given where the U.S.'s national debt is at, I suspect that tax rates will climb even after adjusting for inflation.

If you expect your spending in retirement to be high - at or above the income levels for the 24% bracket, I would heavily consider pushing more money toward the Roth 401(k) to hedge against future tax increases.