401(k) Rollovers

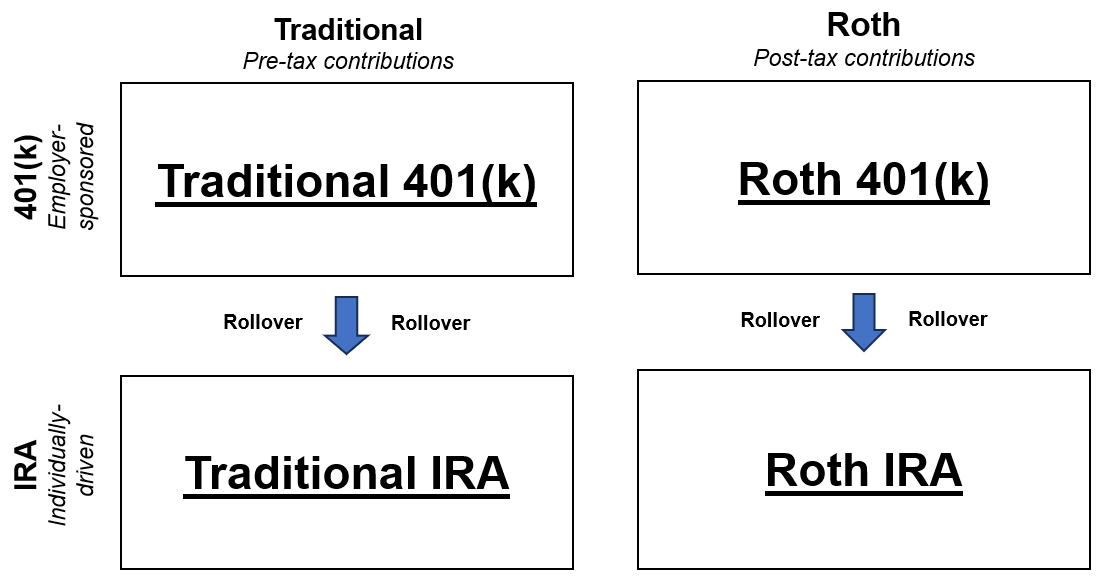

Once you leave an employer, the IRS will allow you to roll over your 401(k) balance into either an individual retirement account (IRA) or your current employer's 401(k) without penalty. Depending on the circumstance, rolling over a 401(k) from a previous employer could be a good idea.

There are two main benefits to doing this:

1. You can consolidate all of your past retirement contributions into a single place so that you don't lose track of them, especially if you've worked at many employers.

2. Your previous employer's 401(k) may have management fees or poor investment choices. For example, if you don't have access to a low-cost, passive target date fund (TDF), I would highly consider a rollover.

If you choose to do a 401(k) to IRA rollover, you will want to rollover funds in a Traditional 401(k) into a Traditional IRA and funds in a Roth 401(k) into a Roth IRA to avoid triggering any taxes. Schwab, Fidelity, and Vanguard all offer great Traditional IRAs and Roth IRAs with no fees and passive TDFs. Rollovers are not subject to any contribution limits.

However, if you can't contribute to a Roth IRA directly because you surpass the income thresholds and want to take advantage of the Backdoor Roth (i.e., a process for high-income earners to still contribute to a Roth IRA), then you'll want either leave the 401(k) funds at your previous employer as-is or roll them over to a current employer's 401(k). This is due to the IRS's pro-rata rule, which is a rule to be highly aware of if using the Backdoor Roth process.