401(k)s and IRAs

Retirement accounts can be really tricky to understand since they come in a few different varieties. Below, I'll provide a short overview of each of them, and in the next module, I'll cover some of the nuances.

Skip to:

Traditional 401(k) | Roth 401(k) | Traditional IRA | Roth IRA

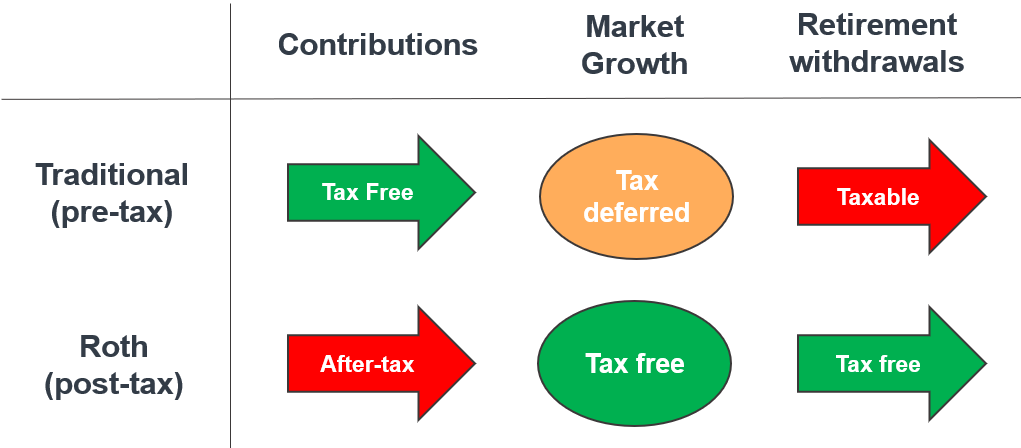

Use this diagram to prime your understanding before reading:

Traditional 401(k)s

A Traditional 401(k) is a retirement savings plan (sponsored by employers) that allows employees to contribute a portion of their salary toward retirement. Your contributions are pre-tax: that is, you won't pay state or Federal income tax in the year you contribute but will when you withdraw from the Traditional 401(k) when you retire. The IRS imposes contribution limits: for 2024, you can contribute up to $23,000 (excluding the employer match), and up to $30,500 if you are above the age of 50.With certain exceptions, you will pay a 10% early withdrawal penalty if you touch what's in the account before you turn 59.5.

The funds you put into a 401(k) can be invested into stocks and bonds, allowing them to grow until you retire, and I recommend passive target date funds (TDFs). See here for more details. Unfortunately, sometimes the fund options an employer offers can be limited - but use the criteria on that page as guidance on what to purchase in your 401(k).

These contributions are sometimes matched by the employer to incentivize participation. In most cases, the employer match varies between 3% and 6% of your income and is free money.

Roth 401(k)s

A Roth 401(k) is the Traditional 401(k)'s counterpart - it is less commonly offered by employers. Similar to a Traditional 401(k), contributions can be invested. The main difference, however, is that Roth 401(k) contributions are after-tax (meaning that taxes are paid upfront) and all withdrawals in retirement are tax-free. In other words, what you put in now can grow tax-free indefinitely. A couple things to note:

1. Both the Traditional 401(k) and Roth 401(k) are subject to the same annual contribution limit: you can't contribute $46,000 to both.

2. Roth 401(k)s are more appealing when your marginal tax rate is low - in general, this is earlier in your career.

If you have access to both, read this page on how to make the decision on whether to contribute to a Traditional or Roth 401(k).

Traditional IRAs

IRA stands for "Individual Retirement Account" and is not tied to an employer: anyone can open one. Given the low contribution limits that are shared with the more superior Roth IRA, I do not recommend contributing to a Traditional IRA (TIRA). However, you may still want to consider opening a TIRA: they're necessary if you want to contribute to a Roth IRA via the backdoor method or want to consolidate (rollover) your 401(k)s from previous employers into a single place.

Roth IRAs

A Roth IRA is a retirement account that you can open independently, offering tax advantages similar to a Roth 401(k). See this page for the best brokerages to open up a Roth IRA.

Unlike Traditional accounts and similar to the Roth 401(k), contributions to a Roth IRA are made with after-tax dollars, meaning taxes are paid upfront. The primary advantage of a Roth IRA lies in its tax-free growth potential: withdrawals in retirement, including both contributions and earnings, are not subject to federal income tax. Additionally, Roth IRAs offer flexibility with withdrawals, allowing penalty-free access to contributions, making them extremely versatile.

For 2024, the contribution limit is $6,000 ($7,000 if you're 50 or older). You can contribute to a Roth IRA directly if your Modified Adjusted Gross Income (MAGI) is less than $146,000 for those filing 'single' and less than $230,000 for those filing 'married, filing jointly.' If your income surpasses this amount, you can contribute to a Roth IRA using the backdoor method.