DIYFi: What to invest in (taxable accounts)

Note: These portfolio recommendations are only for taxable accounts. For tax-advantaged accounts (e.g., 401(k)s, IRAs, HSAs), I recommend low-cost target date funds (TDFs), which I cover extensively in the retirement section. TDFs follow the same principles I lay out here (i.e., a global portfolio) but because they shift toward bonds as you age, they are tax-inefficient in taxable accounts: the income the bonds generate are subject to short-term capital gains tax (i.e., regular income tax) instead of the long-term capital gains tax. The distribution from bond funds suggested here are either tax-efficient or tax-free.

Skip to:

Buy the entire market | How to build a global portfolio | DIYFi portfolio builder | US v. International stocks

Buy the entire market

It's nearly impossible to predict the winners and the losers in the stock market: no one has a crystal ball. In fact, Warren Buffet, in the 2023 Berkshire Hathaway annual report, is quoted as saying:

"Within capitalism, some businesses will flourish for a very long time while others will prove to be sinkholes. It's harder than you would think to predict which will be the winners and losers. And those who tell you they know the answer are usually either self-delusional or snake-oil salesmen."

If this is the case, the easiest way to invest is to buy the entire market. Basically, you're betting on global growth.

The introduction of low-cost, passive index funds in the past two decades has made this very easy. You can buy virtually the entire global stock market with 2 or fewer funds depending on your brokerage. You can even automate purchases!

And in fact, robo-advisors are doing same thing - just charging you a premium to do so.

How to build a global portfolio

Using mutual funds

The current market caps are approximately 62% for the US and 38% for International. This means that the US stock market represents 62% of all equities and the rest of the world represents 38%. In order to purchase a globally-diversified portfolio, you should mimic these ratios: that is, if you had $1,000 to invest, I would recommend purchasing $620 worth of US equities via a US Total Market Index Fund and $380 worth of foreign equities via a International Market Fund.

You can skip ahead to the DIYFi portfolio builder to see recommendations tailored to you based on your brokerage and age.

| Criteria | Schwab | Fidelity | Vanguard |

| US Total Market | SWTSX | FSKAX | VTSAX |

| International Market | SWISX* | FTIHX | VTIAX |

| US and Int. equities in one fund (one and done) | n/a | n/a | VTWAX |

| Short-duration or tax-exempt bond fund | SWSBX | FNSOX | VTEAX |

| Avg. equity expense ratio | 0.04% | 0.03% | 0.07% |

Note: Schwab's International Index Fund does not include emerging markets. The added diversication benefit is minimal but not non-existent.

Using exchange traded funds (ETFs)

For buy-and-hold investors, there won't be a material difference between holding mutual funds and ETFs. However, if you are curious about the difference, you can read this page which compares mutual funds and ETFs.

When it comes to investing, the largest downside of ETFs at major brokerages (unlike mutual funds) is that you cannot automate the purchases. But if you want to manually purchase a single fund that tracks the global equities market, your best bet will be the Vanguard Total World Stock ETF (VT). In fact, this is my go-to fund whenever I make investment purchases that aren't already automated.

DIYFi's mutual fund portfolio builder

US v. International stocks

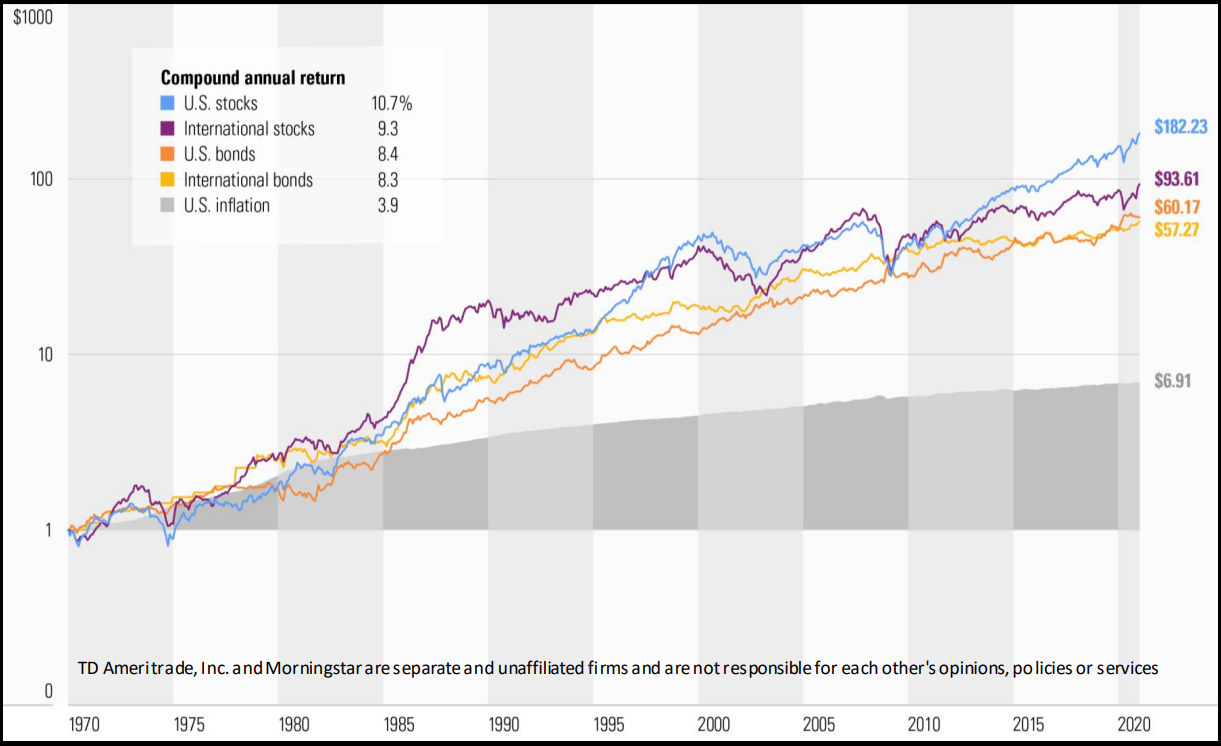

Many investors sometimes exclude adding foreign stocks in their portfolios, citing US outperformance over international stocks since 2008. My theory is that this is driven by recency bias: if you draw this trend out back to 1970, you can see that there are many decades in which international stocks outperformed the US market. The added diversification from having a portfolio with international stocks gives you exposure to both the US and foreign without having to worry about picking a winner or picking a loser.

The early 1970s mark the furthest point back where reliable data allows us to precisely track global stock market numbers. However, rough data on world markets can be traced back to the 17th century. Similar to the US, there have been other countries that once held dominant positions in the global market but gradually underperformed over the long term. A prime example is the United Kingdom: if you were a stock market investor in the early 1900s, it would've been unwise to not include the UK in your portfolio, as they held approximately 25% of the world's market capitalization at the time; but the UK's current market capitalization hovers around 4%.

This same example can be applied to the US - in 30 years, it might not hold 62% of the world's market capitalization...it might be closer to 40%. The US doesn't necessarily need to collapse for returns to turn negative; it just needs to possess a smaller share of capital compared to other investible securities.